Pilot Institute Survey: 8,056 Operators Reveal DJI Ban Will Devastate American Drone Industry

Amazon Drone Deals: DJI Mini 5 Pro Fly More Combo with DJI RC2 now for $1,099!

I’ve been warning about the consequences of a DJI ban for over a year. Now we have the data to prove it. Pilot Institute surveyed 8,056 drone operators across the United States, and the findings confirm our worst fears: the ban that took effect on December 22, 2025 will devastate the American drone industry while doing nothing to address the security concerns it claims to solve.

Here’s what 8,056 operators told Pilot Institute about the DJI ban’s impact:

- What: First comprehensive survey of American drone operators on the DJI ban’s real-world impact

- Who: 8,056 respondents including Part 107 pilots, recreational users, first responders, and businesses of all sizes

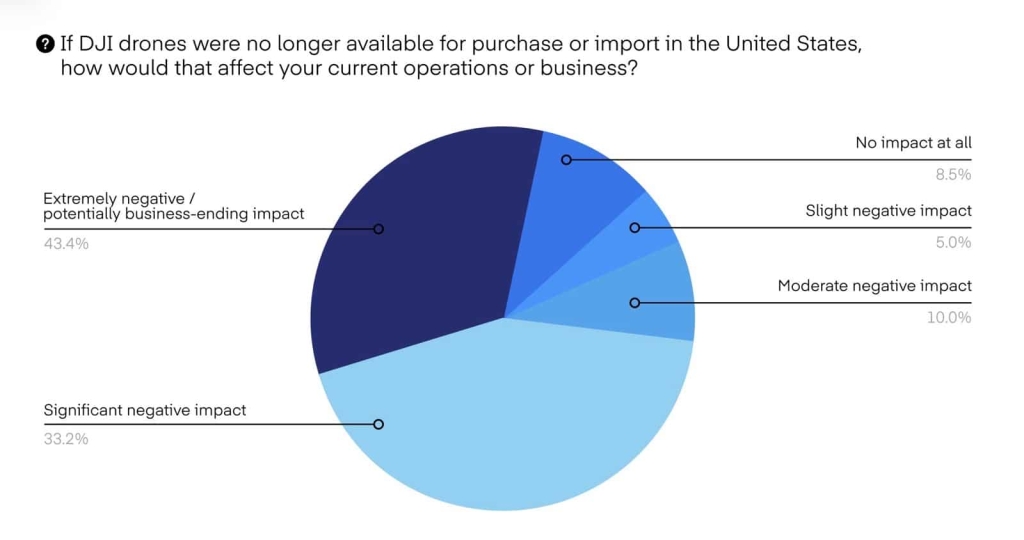

- Key finding: 43.4% say the ban will have an “extremely negative/potentially business-ending impact”

- Why it matters: 81% of the industry will reduce or cancel future drone investments, strangling the pipeline of new pilots and businesses

The Wall Street Journal first reported on this survey on December 23, the same day the FCC officially added all foreign-made drones to the Covered List. But the mainstream coverage missed the most important finding: this ban will destroy the future of the American drone industry by eliminating the affordable entry point that created the current generation of pilots.

The Numbers That Should Terrify Policymakers

Let’s start with the headline figure: 70% of all drone operators surveyed run fleets that are 100% DJI. Not “mostly DJI.” Not “partially DJI.” Every single aircraft in their fleet carries a DJI logo.

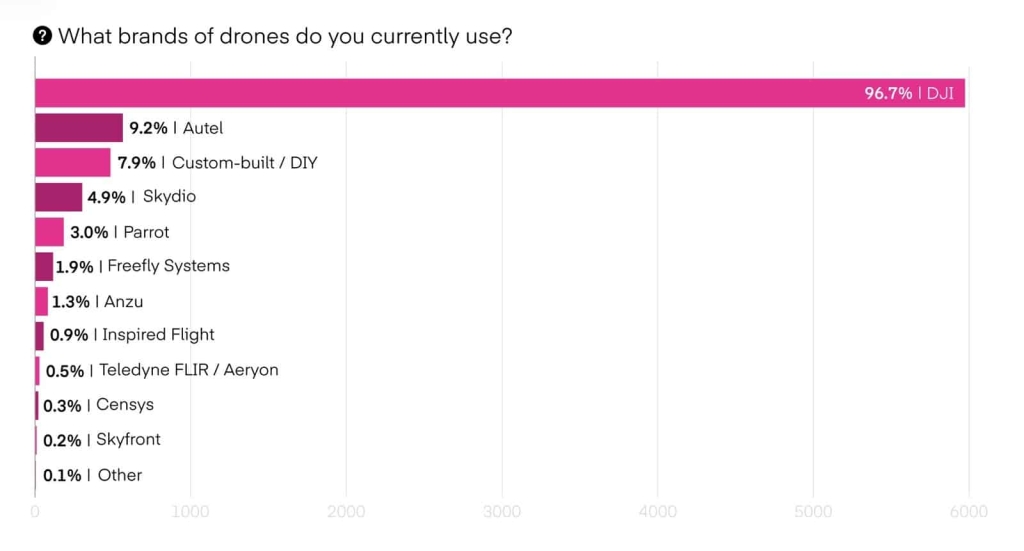

The market concentration is even more stark when you look at overall usage. 96.7% of drone operators use DJI products. For comparison, Autel comes in at 9.2%, custom-built drones at 7.9%, and Skydio at just 4.9%. The “American alternatives” that ban proponents keep promising simply do not exist at scale.

| Brand | Usage Rate |

|---|---|

| DJI | 96.7% |

| Autel | 9.2% |

| Custom-built / DIY | 7.9% |

| Skydio | 4.9% |

| Parrot | 3.0% |

| Freefly Systems | 1.9% |

| Anzu | 1.3% |

| Inspired Flight | 0.9% |

Current drone brand usage among 8,056 surveyed operators. Percentages exceed 100% because operators can use multiple brands.

The public safety numbers are even more damning. 97% of public safety agencies use DJI drones, and only 13% use Skydio. When Arizona Fire Chief Luis Martinez warned Congress that “lives are going to be lost because this air capability is going to be taken away,” this is what he meant.

The Business Impact: One in Four Operators Will Shut Down

When asked what they would do if the DJI ban were implemented, the responses paint a picture of an industry in crisis:

- 26.4% will continue operations but with higher costs and lower margins

- 23.8% will shut down their drone-related business entirely

- 16.7% will reduce the amount of drone work they do

- 12.1% selected “other”

- 11.3% will shift their work away from drones to other services

- 9.7% will invest heavily in non-DJI alternatives

Nearly one in four operators will simply close up shop. For Part 107 pilots who built businesses around aerial photography, real estate, inspections, and mapping, the math no longer works when equipment costs triple and capabilities decline.

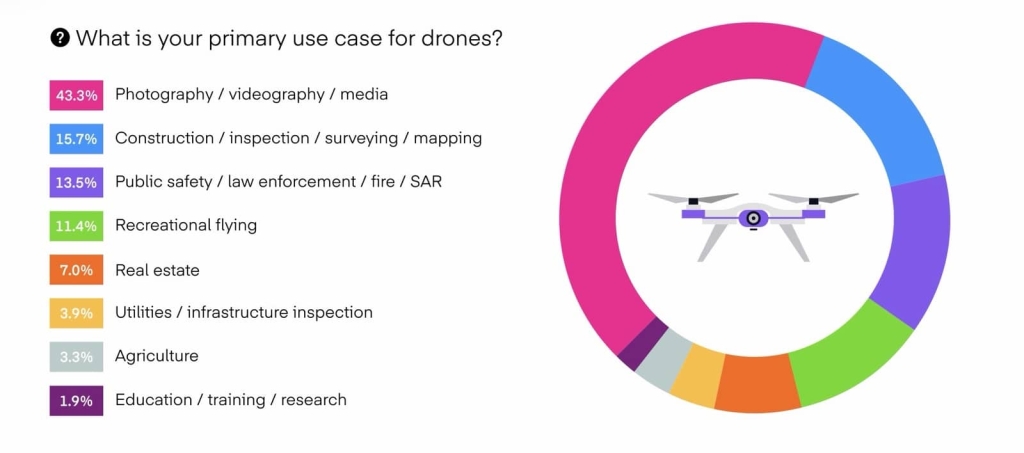

The sector-by-sector breakdown reveals which industries face the most severe disruption:

| Industry Sector | % Who Will Shut Down Business |

|---|---|

| Agriculture | 31% |

| Education / Training / Research | 27% |

| Construction / Inspection / Mapping | 26% |

| Photography / Videography / Media | 25% |

| Public Safety / Law Enforcement / Fire / SAR | 22% |

| Real Estate | 20% |

| Utilities / Infrastructure Inspection | 20% |

| Recreational Flying | 13% |

| Survey Average | 24% |

Percentage of operators who say they will shut down their drone business due to the DJI ban, by industry sector.

Agriculture gets hit hardest, with nearly one-third of operators planning to shut down. This matters because drone-based crop monitoring has become essential for precision agriculture. When farmers lose the ability to detect irrigation problems, pest infestations, and yield variations from the air, they lose money and waste resources.

The Pipeline Problem Nobody Is Talking About

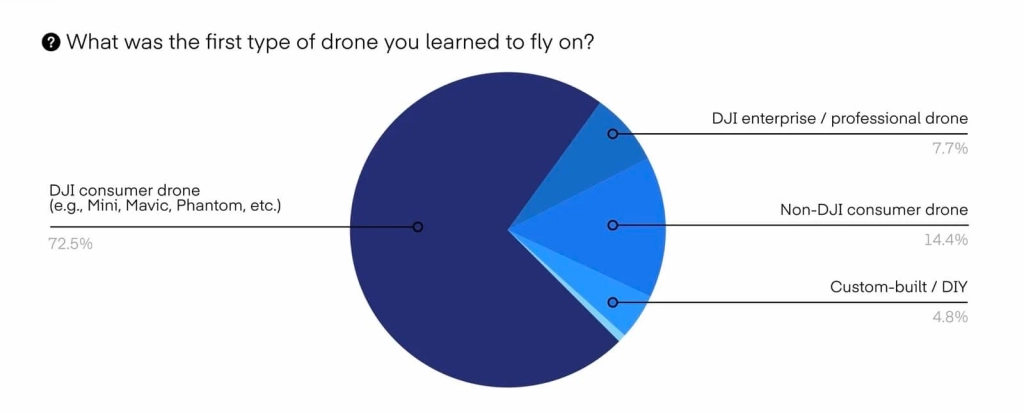

Here’s the finding that should alarm anyone who cares about the future of American aviation and robotics: 87% of current drone operators learned to fly on a DJI drone.

The breakdown of first drones is revealing:

- 72.5% learned on a DJI consumer drone (Mini, Mavic, Phantom, etc.)

- 14.4% learned on a non-DJI consumer drone

- 7.7% learned on a DJI enterprise/professional drone

- 4.8% learned on a custom-built/DIY drone

The consumer drone market is where future commercial pilots come from. A kid who gets a DJI Mini for their birthday might become a Part 107 pilot running an inspection business ten years later. An engineer who buys a Mavic for weekend flying might develop the next breakthrough in autonomy. That pipeline doesn’t exist without affordable, capable consumer drones.

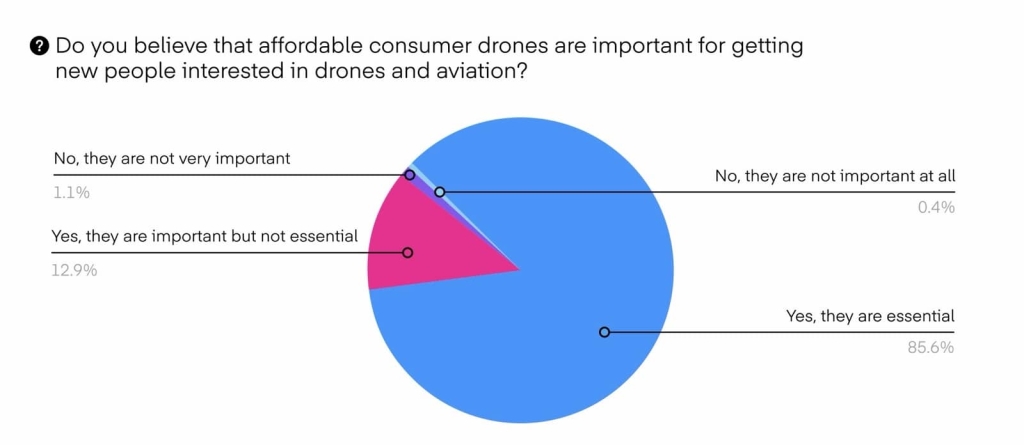

The survey confirms this concern. When asked whether affordable consumer drones are important for getting new people interested in drones and aviation:

- 85.6% said they are “essential”

- 12.9% said they are “important but not essential”

- 1.1% said they are “not very important”

- 0.4% said they are “not important at all”

And when asked what would happen if affordable consumer drones became much harder to obtain:

- 83.8% said the number of new people entering the industry would “decrease significantly”

- 13.9% said it would “decrease somewhat”

- 1.7% said there would be “no real change”

- 0.7% said the number might even increase

This is the long-term damage that the FCC’s December 22 decision will inflict. Not just today’s businesses, but tomorrow’s pilots, engineers, and entrepreneurs.

No Alternatives Exist for 29% of Operators

The survey asked operators whether they had seriously evaluated or started transitioning to non-DJI platforms. The responses expose the “just switch to American drones” fantasy:

- 36.2% plan to start evaluating alternatives soon

- 29.1% say no platforms are currently available that fit their needs

- 15.1% already use non-DJI platforms as their main tools

- 14.1% have evaluated alternatives but haven’t switched

- 5.5% don’t have plans to switch

Nearly one-third of the industry says alternatives simply don’t exist for their use cases. This isn’t operator stubbornness. It’s market reality.

The barriers are significant. Among those who evaluated non-DJI alternatives:

- 64.3% cited higher purchase costs

- 64.3% cited lower performance (flight time, camera quality, etc.)

- 54.9% cited less reliable or mature hardware

- 53.3% cited lack of features they depend on

- 39.2% cited limited software ecosystem/integrations

Public safety agencies face the steepest barriers. 86% of public safety users cited higher purchase costs as a barrier to switching, compared to the 64% average. When Florida’s $200 million DJI ban disaster forced agencies to transition, approved replacements failed five times in 18 months while DJI had zero failures in five years.

The Investment Freeze Has Already Begun

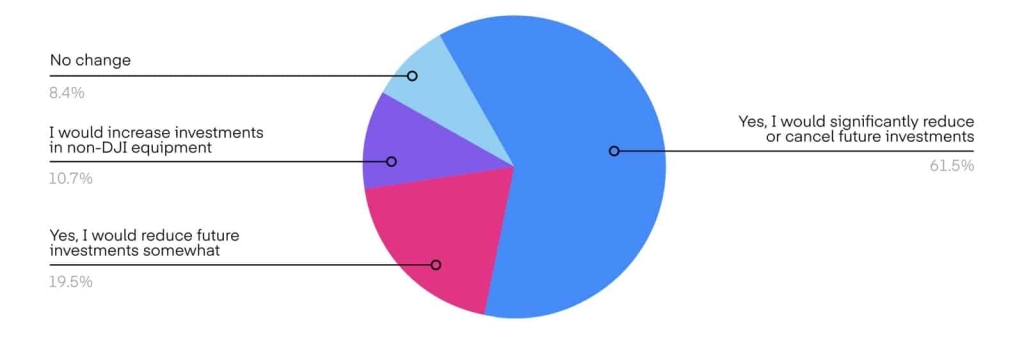

Perhaps the most consequential finding: 81% of the industry will reduce future drone investments.

When asked whether a DJI ban would change plans for future investment in drones:

- 61.5% would “significantly reduce or cancel future investments”

- 19.5% would “reduce future investments somewhat”

- 10.7% would “increase investments in non-DJI equipment”

- 8.4% said “no change”

This is an investment freeze across an entire industry. Training programs won’t hire. Equipment upgrades won’t happen. New services won’t launch. The economic ripple effects will extend far beyond the drone operators themselves.

DJI’s Head of Global Policy Adam Welsh cited figures of 460,000 American jobs and $116 billion in economic activity tied to DJI in the U.S. market. Even if those numbers are optimistic, the survey data confirms the ban will cause substantial economic damage.

The Supply Chain Crisis Is Already Here

Note that this survey was conducted before the FCC action on December 22, 2025. Even then, operators were already experiencing significant supply chain disruptions:

- 45.6% reported noticeably higher prices for DJI drones or parts

- 41.8% were unable to purchase a specific DJI model they wanted

- 33.3% could not get needed DJI parts or accessories

- 21.6% had a DJI drone order delayed significantly

- 8.0% had a DJI drone order cancelled

- 29.5% reported no issues with DJI availability

These issues stem from the U.S. Customs and Border Protection (CBP) actions in 2024, when the agency cited the Uyghur Forced Labor Prevention Act (UFLPA) and asked DJI to prove compliance. CBP blocked most DJI shipments while DJI attempted to prove they weren’t in violation. DJI subsequently announced they would no longer offer CareRefresh in the U.S., and their last three drone models were released everywhere in the world except the United States.

The financial impact of these pre-ban disruptions:

- 15% of companies with 6-20 employees reported losses of $50,000 or more

- One-quarter of agricultural users reported losing jobs or contracts

- 42% of public safety users said it made their work more difficult

Operational Sustainability: The Two-Year Countdown

The survey reveals a ticking clock for drone operations across America. When asked how long they could continue operating with their current fleet if DJI drones were no longer available:

- Most agricultural users said they could operate up to 1 year

- Most public safety users said they could keep operating up to 2 years

- 85% of businesses said they could survive two years or less without access to new foreign-made drones

Batteries wear out. Motors fail. Drones crash. Without replacement parts and new equipment, existing fleets degrade. The servicing implications are critical: DJI’s standard practice of replacing unrepairable units with new ones becomes impossible under the ban.

What Operators Actually Want From Policy

The survey asked operators which policy approach they preferred:

- 49.8% prefer no additional restrictions on DJI beyond current rules

- 47.0% prefer targeted restrictions only for sensitive government or critical infrastructure uses

- 2.3% prefer broad restrictions on new DJI purchases but allow existing fleets to keep operating

Nearly everyone supports either maintaining the status quo or implementing targeted restrictions for genuinely sensitive applications. Almost nobody supports the blanket ban the FCC just implemented.

The concern level is overwhelming:

- 57.8% are “extremely concerned” about potential federal restrictions

- 25.5% are “very concerned”

- 10.9% are “moderately concerned”

- 3.6% are “slightly concerned”

- 2.2% are “not at all concerned”

Utilities and infrastructure inspection users were the most concerned, followed by public safety, photography/videography, and real estate operators.

DroneXL’s Take

This survey confirms everything we’ve been reporting for the past year. The DJI ban isn’t a security policy. It’s a regulatory trap that will cost American lives, destroy small businesses, and strangle the pipeline of future pilots and innovators.

Here’s what I expect: The two-year clock is now ticking. As batteries die, motors fail, and drones crash without replacement options, we’ll see a wave of business closures and capability losses. Public safety agencies will operate with degraded or eliminated drone programs. The “American alternatives” that Senator Rick Scott promised will be “figured out pretty fast” will remain years away from matching DJI’s capability-to-cost ratio.

The cruelest irony is that this ban happened without the security review Congress mandated. DJI begged for that audit. They sent letters in March, June, and December 2025 asking agencies to examine their products. The response was silence. No agency started the review. No evidence was gathered. No findings were made.

Instead, 8,056 American drone operators just had their livelihoods threatened, their capabilities degraded, and their industry’s future compromised by a ban based on nothing but bureaucratic inaction and the lobbying money of domestic competitors who can’t match DJI on merit.

Greg Reverdiau of Pilot Institute told the Wall Street Journal: “People are not buying the drone because it’s a Chinese drone. They are buying the drone because it is available, it’s highly affordable, and it’s capable.”

That’s the Delta the policymakers missed. And 8,056 operators just told them exactly what the consequences will be.

How is this ban affecting your operations? Are you planning to shut down, reduce services, or invest in alternatives? Share your experience in the comments below.