Skyany X1 Emerges As Latest DJI Mini 4 Pro Clone On Amazon Ahead Of December Ban

Amazon Prime Deals: DJI Mini 4K for $239, DJI Neo for $159, Skyrover X1 FMC for $718!

DJI’s shell company strategy continues expanding with the Skyany X1, a new Amazon-available drone that’s essentially identical to the previously reported Skyrover X1—both rebranded DJI Mini 4 Pro drones manufactured in Malaysia. The discovery, highlighted in a recent video by Half Chrome‘s Jack Towne, reveals how DJI is accelerating its workaround operations as the December 23, 2025 regulatory deadline approaches.

- Skyany X1 Drone with Camera for $758 on Amazon

- Skyany X1 Fly More Combo, Drones with Camera for $898 on Amazon

For U.S. drone pilots facing uncertainty about DJI’s future in America, the Skyany X1 represents another avenue to access Mini 4 Pro-level performance without direct DJI branding. With Amazon Prime shipping and competitive pricing, these rebranded drones offer an immediate solution while the regulatory clock ticks down.

Latest Addition To DJI’s Shell Company Network

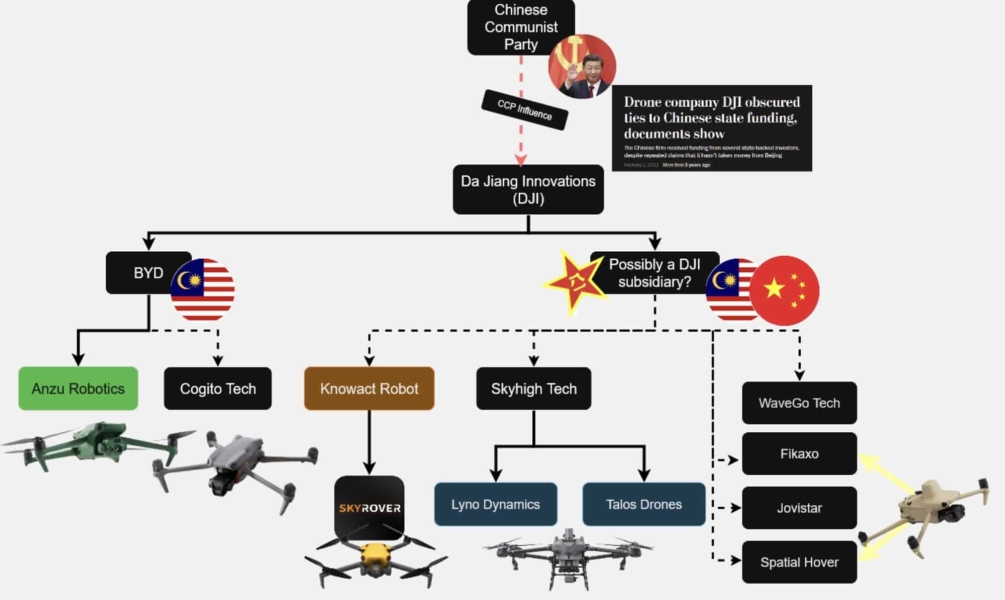

The Skyany X1 joins a rapidly growing list of DJI-based drones marketed under alternative brand names. According to security researcher Konrad Iturbe’s investigations, the network now includes Cogito, Skyrover, Skyany, Fikaxo, Jovistar, Spatial Hover, and several others—all using DJI’s proprietary OcuSync communication protocols identifiable through FCC filings.

The Skyany Amazon storefront mirrors the Skyrover setup almost identically, using the same product images and even the same Sky Rover app for drone operation. “I was doing a little bit of poking. They’re using the exact same images as the Sky Rover,” Jack noted in his video. “This app, I think it was, I found that they just use the Sky Rover app.”

The drone features the same sub-250 gram (8.8 ounce) weight, 4K camera with 1/1.3-inch CMOS sensor, 360-degree obstacle avoidance, and up to 32 minutes of flight time as both the Skyrover X1 and DJI Mini 4 Pro.

Pricing And Availability On Amazon

The Skyany X1 is currently available on Amazon in two configurations. The standard drone package sells for $758, while the Fly More Combo—including three batteries, charging hub, and carrying case—retails for $898. Both options qualify for Amazon Prime two-day shipping.

These prices undercut the original DJI Mini 4 Pro’s launch pricing while offering what’s essentially the same hardware in a bright yellow case. The Skyrover X1 Fly More Combo currently sells for $898 with occasional coupon discounts bringing it to $818.

How Skyany Connects To Skyrover And DJI

DJI’s approach involves manufacturing drones in Malaysia and licensing the designs to various companies that then sell them through Amazon. This strategy technically separates the DJI brand from the final sale while maintaining the same technology, firmware, and performance characteristics.

The shared Sky Rover app between both Skyany and Skyrover products suggests coordinated backend operations rather than truly independent companies. Security researchers previously discovered that the Skyrover app contains direct connections to DJI’s cloud infrastructure and FlySafe services, confirming the technical relationship.

Amazon’s return policy provides some consumer protection for those hesitant about purchasing from these newer brands. “Listen, it’s Amazon,” Jack pointed out. “Amazon has a great return policy. So, if you feel like it’s not working, they’re not going to let you get scammed.”

December Deadline Drives Shell Company Surge

The proliferation of DJI-based brands correlates directly with mounting political pressure. Section 1709 of the FY2025 National Defense Authorization Act requires a U.S. national security agency to determine whether DJI poses an unacceptable risk by December 23, 2025. If no agency completes the mandated security review by that deadline, DJI will automatically be added to the FCC’s Covered List.

This designation would block new DJI products from receiving FCC equipment authorizations, effectively preventing future sales in the United States. As of October 2025, no federal agency has scheduled the required security assessment, making the automatic restriction increasingly likely.

The shell company strategy allows DJI to maintain U.S. market presence through licensed alternatives while the regulatory situation remains unresolved. “I think DJI is going to continue to do this,” Jack predicted. “They did it with Specta. They did it with Sky Rover; they did it with Sky Annie. There’s Anzu Robotics, which is kind of slightly different, and then some other things that they’ve done, but they’re finding ways to get their products into the United States.”

DroneXL’s Take

The Skyany X1 emergence demonstrates how quickly DJI is adapting its distribution strategy as the December deadline approaches. What’s particularly interesting is the minimal effort to differentiate these brands—using identical product images, shared apps, and near-identical Amazon storefronts suggests this is about regulatory workarounds rather than building distinct brand identities.

We’ve been tracking this shell company network since Konrad Iturbe first exposed Cogito’s Specta drones in March 2024. The pace has accelerated dramatically in 2025, with new entities appearing almost monthly. Fikaxo, Jovistar, Spatial Hover, and now Skyany have all submitted FCC applications since July.

For U.S. pilots, these alternatives offer a practical solution to an increasingly complicated situation. The Mini 4 Pro remains one of the best sub-250 gram drones available, and accessing that technology through Skyany or Skyrover provides comparable performance with Amazon’s consumer protections. The real question is whether these workarounds will survive regulatory scrutiny or if authorities will eventually close these loopholes.

The bigger picture reveals an industry adapting to political pressure in real time. With DJI controlling over 70% of the global drone market and no competitive U.S. alternatives at similar price points, these shell companies fill a genuine market need. Whether that justifies the regulatory runaround remains hotly debated.

What do you think? Share your thoughts in the comments below.