DJI Shell Company Jovistar Signals Mini 5 Pro Clone For U.S. Market

FCC filings reveal Jovistar Inc., a newly identified, suspected DJI shell company, has submitted documents for an unmanned aircraft with specifications closely matching the DJI Mini 5 Pro, complete with LiDAR capability that could circumvent ongoing U.S. import restrictions.

READ MORE: DJI FACES DECEMBER BAN DEADLINE AS POLITICAL PRESSURE SPAWNS PROXY COMPANY NETWORK

Jovistar’s business information seems to perfectly match the address information and name in the FCC filings. The company was apparently already created in February of this year, indicating that this is in fact, part of a planned strategy by DJI.

This discovery comes just one day after DroneXL exposed DJI’s expanding network of shell companies, highlighting how the Chinese drone giant is adapting to U.S. political pressure. The timing suggests a coordinated strategy to maintain market presence despite U.S. Customs and Border Protection restricting DJI shipments since October 2024 under the Uyghur Forced Labor Prevention Act.

Battery Specifications Point to DJI Mini 5 Pro Clone

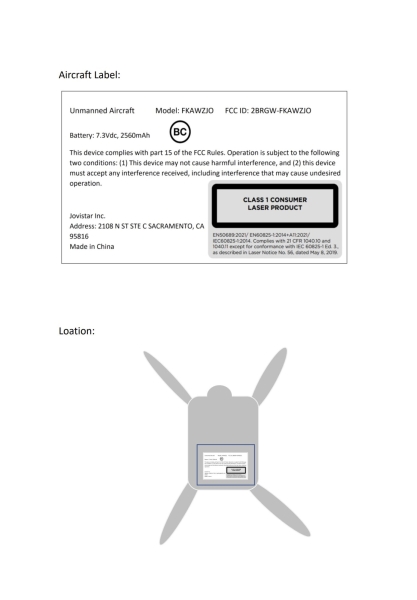

The FCC filing for model FKAWZJO shows critical specifications that closely match DJI’s newest consumer drone:

- Battery: 7.3Vdc, 2560mAh

- DJI Mini 5 Pro Standard Battery: 7.0V, 2788mAh

- Class 1 Consumer Laser Product designation indicating LiDAR integration

These specifications exclude larger DJI models like the Air 3S (14.6V, 4276mAh) and Mavic 4 Pro (14.32V, 6654mAh), which require significantly higher voltage and capacity batteries. The voltage and capacity alignment strongly suggests Jovistar’s drone is a Mini-series aircraft with LiDAR capability.

LiDAR Confirms Advanced Features

The “Class 1 Consumer Laser Product” classification is standard for LiDAR-equipped devices, indicating eye-safe laser systems commonly used in drone obstacle avoidance. Among current DJI drones, only three models feature LiDAR: the Mini 5 Pro, Air 3S, and Mavic 4 Pro. The battery specifications eliminate the larger models, leaving the Mini 5 Pro as the only viable match.

Security researcher Konrad Iturbe notified DroneXL today about this latest Jovistar FCC filing, matching DJI’s distinctive OcuSync radio frequencies. Iturbe has proven invaluable in identifying DJI’s expanding network of subsidiary companies attempting to maintain U.S. market access.

DJI’s Strategic Response to Import Crisis

DJI’s shell company strategy has intensified as the company faces its most severe U.S. market challenges. With all DJI models listed as “sold out” on the official U.S. store and major retailers like Best Buy and Amazon reporting critically low inventory, alternative distribution channels have become essential.

The Mini series represents DJI’s most successful consumer product line globally, making it a logical choice for shell company distribution. Since DJI cannot officially launch the Mini 5 Pro in America due to customs uncertainty, a Jovistar-branded clone would fill this market gap while technically avoiding direct DJI import restrictions.

This approach mirrors DJI’s existing partnerships with Cogito Tech and Skyrover for “Specta” and “X1” Mini 4 Pro clone models. The pattern suggests a systematic effort to maintain U.S. market presence through proxy companies, something that DJI will not confirm or deny.

Regulatory Timing Pressure

The urgency behind shell company creation stems from looming regulatory deadlines. The FY 2025 National Defense Authorization Act mandates a security review of DJI products by December 23, 2025. If incomplete, DJI will automatically join the FCC’s “Covered List,” effectively banning new drone sales by restricting spectrum access.

Additionally, the Commerce Department continues evaluating broader restrictions on Chinese drone components, while Congress reviews the Countering CCP Drones Act. These converging pressures create a narrow window for establishing alternative distribution networks.

DroneXL’s Take

Jovistar’s emergence seems to represent DJI’s latest shell company operation yet, targeting the lucrative consumer Mini series market with advanced LiDAR technology. The precise battery specification matching and laser product classification suggest this isn’t just rebranding—it’s a carefully engineered workaround to regulatory restrictions.

The bigger question is whether U.S. authorities will recognize and act on these shell company patterns before they become entrenched. With DJI controlling over 70% of the global drone market, these proxy operations could fundamentally reshape how Chinese technology enters American markets.

What concerns should drone operators have about purchasing through shell companies versus direct manufacturers? Share your thoughts on this evolving regulatory chess game in the comments below.