DJI’s Shell Company Gambit Backfired Spectacularly, And The Entire Drone Industry Paid The Price

Amazon Drone Deals: DJI Mini 5 Pro Fly More Combo with DJI RC2 now for $1,099!

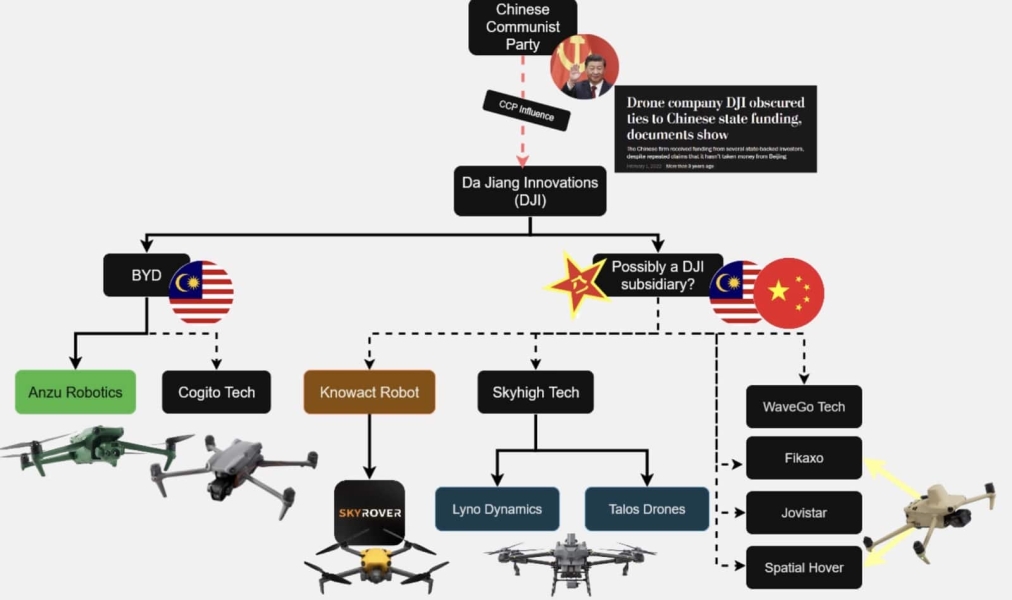

I’ve spent months documenting DJI’s network of suspected shell companies, from Skyany to Spatial Hover to Jovistar. What started as investigative journalism became a front-row seat to watching a company outsmart itself into oblivion. Now that the dust has settled on the December 23 FCC ban, one uncomfortable truth has become impossible to ignore: DJI didn’t have to lose this badly. They chose to.

Here’s the thing that keeps gnawing at me. The original legislation targeted DJI and Autel specifically. That was the scope. Two Chinese drone companies, both facing scrutiny, both looking at potential restrictions on new product authorizations. It was bad, but it was contained. DJI could have accepted the political reality, focused on their massive global market outside the United States, and waited for the pendulum to swing back.

Instead, they got clever.

The Arrogance of Thinking You Can Outsmart Washington

When DJI started setting up shell companies to sell rebranded drones through alternative channels, they sent an unmistakable signal to U.S. lawmakers: “We will find ways around whatever restrictions you impose.” And they did it with all the subtlety of a sledgehammer. We documented FCC filings where DJI logos weren’t even properly removed. Security researcher Konrad Iturbe built an automated system that could identify DJI products regardless of branding just by looking at their OcuSync frequency signatures.

The shell game wasn’t just transparent. It was insulting. DJI essentially told the U.S. government that their legislative efforts were an inconvenience to be routed around, not a policy position to be respected or challenged through legitimate channels.

What did DJI expect would happen? That lawmakers would shrug and say, “Well, you got us, enjoy selling your Skyrover drones”?

The response was predictable to anyone who understands how Washington actually works. Rather than accept being outmaneuvered, legislators broadened the ban in ways that made evasion impossible. The FCC’s October vote granting itself retroactive enforcement authority and the ability to target component parts didn’t come from nowhere. It came from watching DJI treat U.S. law as optional.

DJI Thought They Were Smarter Than Everyone Else

I’ve spoken with people across the drone industry over the past few weeks, from trade association insiders to policy experts. The consensus is damning: DJI’s leadership fundamentally misread the room. They believed their market dominance made them untouchable. They believed American lawmakers would either give up or be too incompetent to close loopholes. They believed wrong.

The outcome shocked everyone, including trade associations like AUVSI that are typically plugged into every policy development months before it happens. The scope of the final restrictions went far beyond what anyone anticipated because lawmakers felt they had no choice but to make the ban comprehensive enough that DJI couldn’t evade it through corporate restructuring or Malaysian manufacturing.

Adam Welsh, DJI’s Head of Global Policy, spent months telling anyone who would listen that he was “fighting for the users.” He demanded a transparent, evidence-based review process. He called for the mandated security audit to proceed. And on paper, those were reasonable positions.

But you can’t simultaneously demand transparent engagement while your company runs a shadow import operation through a dozen shell entities. You can’t claim to want a fair process while actively demonstrating that you’ll circumvent any outcome you don’t like. Pick one.

The Collateral Damage Nobody Talks About

What makes this particularly infuriating is who else got caught in the blast radius. The component parts rule doesn’t just affect DJI branded products. It affects every drone manufacturer whose supply chain touches Chinese components, which is essentially every drone manufacturer on Earth. Autel, which was quietly hoping to survive the initial restrictions, got swept up in the broader crackdown. Even Blue sUAS approved American companies faced supply chain scrutiny they hadn’t anticipated.

DJI’s shell company strategy didn’t just doom DJI. It provided the justification for a regulatory framework that will constrain the entire industry for years.

The bitter irony is that DJI might actually be fine with this outcome. Industry sources suggest Frank Wang and DJI leadership care more about market share in China than profitability in America. If the restrictions happen to take out Chinese competitors like Autel in the process? That’s not a bug, it’s a feature. In China, having market share is the whole game. Kill everyone else, even if it means killing yourself in a particular market.

American drone operators were never the priority. They were acceptable losses.

DroneXL’s Take

I’ve covered this industry long enough to recognize a self-inflicted wound when I see one. DJI had options. They could have accepted the initial restrictions and focused their considerable resources on markets where they weren’t facing political headwinds. They could have invested seriously in U.S. manufacturing, following the Toyota playbook from the 1980s when Japanese automakers faced similar protectionist pressure. They could have engaged in good faith with the security audit process they publicly demanded.

Instead, they played games. Shell companies. Rebranded products with barely-changed FCC filings. A strategy that treated U.S. regulators as obstacles to be circumvented rather than stakeholders to be convinced.

“Play stupid games, win stupid prizes.”

The shell company strategy wasn’t clever. It was contemptuous. And the contempt was noticed by exactly the people who had the power to make DJI’s situation dramatically worse. Which they did.

My prediction: DJI will continue to dominate global markets outside the United States, and they’ll use the U.S. ban as evidence of American protectionism rather than acknowledging their own role in escalating the conflict. The narrative in Shenzhen will be that they were victims of unfair treatment, not architects of their own demise. And American drone pilots, first responders, and commercial operators will be left sorting through the wreckage of a supply chain that didn’t have to collapse this completely.

DJI should have just accepted that they lost the first round. Now everyone has lost.

What do you think? Was DJI’s shell company strategy arrogance, desperation, or something else entirely? Let us know in the comments below.

Editorial Note: This article was researched and drafted with the assistance of AI to ensure technical accuracy and archive retrieval. All insights, industry analysis, and perspectives were provided exclusively by Haye Kesteloo and our other DroneXL authors, editors, and YouTube partners to ensure the “Human-First” perspective our readers expect.